Paying New Zealand Inland Revenue from overseas just got easier

How does this work?

Making student loan repayments, paying tax, penalties, child support or interest? Simply login or register, add IR as a recipient within your OFX account using the details below.

- Swift Code: WPACNZ2W

- Account Number: 030049-000110-27

- Address: Westpac, 318 Lambton Quay, Wellington, 6011

Once IR has been added as a recipient in your account, enter your payment details and IR number (you can find it on the IR website). You’ll receive confirmation when the funds have been transferred.

Why choose OFX

- Connected to IRD: Fast, simple, secure transfers to IR from your OFX account

- Competitive rates: Keep more of your money as it travels around the world

- Fast transfers: 80% of major currency transfers processes in 24hrs on receipt of funds to OFX*

- 24/7 support: Talk to a real person at any time, day or night

- Access 20+ currencies: Register with OFX and you unlock 20+ currencies

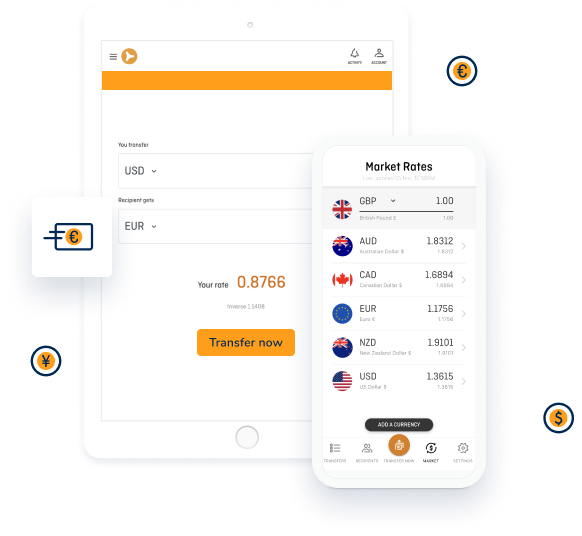

- Easy to use: Check rates, make payments or track transfers online or via our app

*Time zones, public holidays and bank holidays may impact when IR will receive your payment. Transfers can take up to four business days from the time OFX receives your funds. If you are a customer of IR choosing to make a transfer to IR through this service you do so at your own risk. You will be responsible for any penalty interest or other charge payable to IR as a result of late payments. You can track your transfer online or via the OFX app.

Ready to send money? You could be up and running in minutes

1. Open an account

Complete the registration

form in just 5 minutes

2. Send the funds

Enter your recipient’s details

and send OFX the money

by bank transfer

3. Track the transfer

Track your transfer online

or via our OFX app

Transfer your money globally with OFX

With competitive exchange rates and no OFX fees** you’ll always get a great rate on your transaction. With OFXperts available 24/7 you’ll always have help at the end of the phone. And with over 100 bank accounts around the world we’ll always move your money quickly.

** Your bank may charge a fee to send funds to OFX and occasionally intermediary banks may deduct fees on refunds made by OFX for transaction reversals or over payments

FX. It’s what we do.

OFX grew from the idea that there had to be a better, fairer way to move money around the world. That was 20 years ago, and we’re still driven by the same mission today.

We believe real help from real people counts, and that’s why we offer our clients the best of both worlds – an easy to use digital platform, combined with 24/7 phone access to our currency experts (we call them OFXperts).

Foreign exchange is in our DNA. We help clients navigate the complexity of FX, making it simple and easy to understand. Because when it comes to money, informed decisions are the best decisions.

Keeping our clients’ money secure is our top priority. We’re an ASX listed company monitored by over 50 regulators globally. To date, we’ve helped over 1 million customers transfer funds worldwide.

Our clients are all over the globe, so we are too. We operate in offices in London, Ireland, Sydney, Auckland, Hong Kong, Singapore, Toronto and San Francisco. It’s global expertise, delivered locally.

For a rate comparison or to discuss your currency needs, contact your dedicated OFXpert

Bailey Stewart

Email: Bailey.Stewart@ofx.com

Tel: +61 2 8667 8030

*Time zones, public holidays and bank holidays may impact when IR will receive your payment. Transfers can take up to 4 business days from the time OFX receives your funds. If you are a customer of IR choosing to make a transfer to IR through this service you do so at your own risk. You will be responsible for any penalty interest or other charge payable to IR as a result of late payments. You can track your transfer online or via the OFX app.

** Your bank may charge a fee to send funds to OFX and occasionally intermediary banks may deduct fees on refunds made by OFX for transaction reversals or over payments.

© 2024 NZ Forex Limited

NZForex Limited trading as OFX (CN: 2514293) is registered as a financial service provider under the Financial Service Providers (Registration and Dispute Resolution) Act 2008. NZForex Limited is not currently regulated by the Financial Markets Authority as a Derivatives Issuer in New Zealand.

The information on this website does not take into account the investment objectives, financial situation and needs of any particular person. We make no recommendation as to the merits of any financial product referred to on this website.